How to Choose a Certified Financial Planner in Canada

Written by John Woodfield, Portfolio Manager, CIM® CFP®

If you’ve built up your assets and you need to know how to choose a Certified Financial Planner in Canada, this post will help. I’ll explain the qualifications and benefits of working with a CFP, how to find one, and how to check if they are registered and have any disciplinary actions.

I’ll also cover the differences between a Certified Financial Planner (CFP) and a financial advisor and provides a list of questions to ask a potential planner.

TABLE OF CONTENTS

- What is a Certified Financial Planner?

- What are the benefits of working with a Certified Financial Planner?

- What is the difference between a Certified Financial Planner and an investment advisor?

- How To Find a Certified Financial Planner in Canada

- Are Certified Financial Planners regulated in Canada?

- How to Check If a Financial Planner Is Registered

- How to Check for Disciplinary Actions Against a Financial Planner

- Questions to Ask a Financial Planner

- Common Questions about CFPs in Canada

What Is a Certified Financial Planner?

The Certified Financial Planner (CFP) is the most widely recognized financial planning designation worldwide. Certified Financial Planners work with clients to build financial plans so that the potential for a client to meet their financial goals is maximized. Financial planners differ from investment advisors in that planners typically do not give advice on specific investments.

What Does a Certified Financial Planner Do?

Certified Financial Planners work closely with clients to collect data and build financial plans. These plans take into account factors such as the goals of the clients, inflation, taxes, potential investment returns, and insurance.

What Are the Qualifications of a Financial Planner in Canada?

To become a Certified Financial Planner in Canada, the advisor must complete an in-depth education program, followed by a national exam. Also, the candidate must have three years of qualifying work experience. To maintain the designation, a CFP must have over 25 hours of continuing education each year.

Benefits of Working with a Certified Financial Planner

A Certified Financial Planner helps clients create the financial future they want and need. They do this by asking the right questions, collecting data, and forecasting future cash flows, inflation, and potential investment returns. Each person’s situation is unique, and a Certified Financial Planner will take all the details of their client’s situation and tailor the plan to the individual.

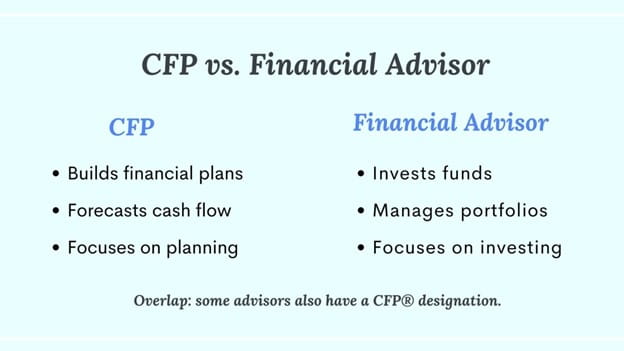

The Difference Between a Financial Advisor and a Financial Planner

A Certified Financial Planner devises plans for individuals based on factors such as the goals of the client and their financial situation. A Financial Advisor invests the funds that a client has on hand based on the needs and goals of the client. In short, a planner's job is planning, and an advisor's job is investing. The two professionals generally work together so each can focus on their specialty while creating a comprehensive strategy. Some people prefer to work with a CFP who is also a Financial Advisor and Portfolio Manager.

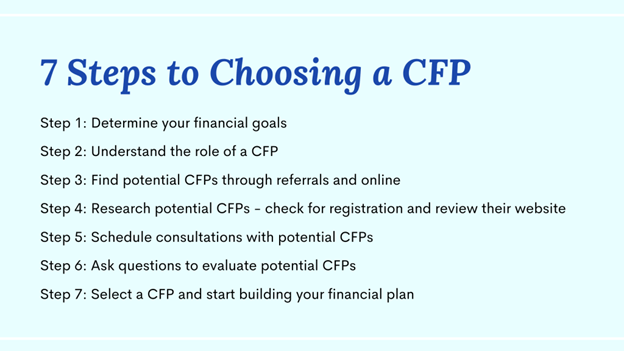

How To Find a Certified Financial Planner in Canada

The best way to find a Certified Financial Planner in Canada is to discuss your need for a plan with your investment advisor. Friends, family, and other professionals are also great resources when seeking a high-quality Certified Financial Planner. No matter the source of the referral, make sure the person you choose is highly experienced and works closely with your investment advisory team. Some investment advisors are also Certified Financial Planners, which gives them a great background in planning. Generally, even advisors with a CFP team up with planners to make sure their clients have a team approach.

Are Certified Financial Planners Regulated in Canada?

In Canada, those trading securities or advising clients on securities-related matters must be registered with the provincial securities regulator. The securities commission regulates Certified Financial Planners who are also investment advisors. The Standards Council regulates those that are not also financial advisors. The council ensures that Certified Financial Planners meet the standards of competence and professionalism through their requirements of ethics, experience, education, and examination.

How to Check if a Financial Planner Is Registered

The best source to find out if your Canadian Certified Financial Planner is registered is the FP Canada website: https://www.fpcanada.ca/findaplanner

How To Check for Disciplinary Actions Against a Financial Planner

The best place to check to see if the Certified Financial Planner has disciplinary action is the FP website: https://www.fpcanada.ca/canadian-public/disciplinary-actions

Questions To Ask a Financial Planner

You should ask these questions to any potential financial planner that you’re considering working with:

- What are your qualifications?

- Are you also investment advisory licensed?

- How long have you been a CFP?

- Do you work with a firm or independently?

- What do you charge for plans, or is it included in the cost I pay an investment advisor?

- What do you deliver once the plan is completed?

- How often do we revisit the plan?

Common Questions about CFPs in Canada

What type of information will my financial planner ask for?

A financial planner will want to know your financial and personal goals. They will need to know your present financial situation, including your investments, real estate holdings, and income. This is generally collected via a series of calls and a detailed questionnaire.

Do you need a degree to be a CFP in Canada?

You do not need a university degree to be a CFP, though having the additional education is always beneficial.

Should I work with a financial advisor or a Certified Financial Planner?

Financial advisors and financial planners bring different skill sets to the table. Sometimes financial advisors also have the CFP. We all know that specialists usually beat generalists. Most financial advisors specialize on the investment side, while the planners are focused on planning factors such as a client’s cash flow and the effects of taxation.

One major benefit of having a CFP who is also an investment advisor is that they are subject to much more regulation and scrutiny. Also, CFPs that are also investment advisors typically work for a larger company as part of a team that contains fully focused financial planners.

Summary of Key Points:

- Certified Financial Planners help structure your financial future.

- Certified Financial Planners that are also investment advisors are subject to a higher level of scrutiny and often work with a team of professionals.

- To find a Certified Financial Planner, look first to your investment advisory team, friends, and other professionals such as accountants and lawyers.

Next Steps

If you’re a Canadian or US resident or are planning on moving across the border and need assistance with transferring and optimizing your investments, estate planning, wealth management and portfolio management, please get in touch. At SWAN Wealth, we specialize in cross-border financial planning, Canadian financial planning, US retirement planning, and cross-border wealth management. We work with Canadians and Americans on both sides of the border.

More Financial Planning Articles & Guides

If you’re planning your retirement or looking to build your wealth management team in Canada, these articles and guides will help.

How to Choose a Wealth Management Firm in Canada

How to Find a Wealth Manager in Canada

Trusts in Canada - A Complete Guide

Retiring in Vancouver - Everything You Need to Know

About the Author

John Woodfield is a Financial Management Advisor (FMA), a Chartered Investment Manager (CIM), and a Certified Financial Planner (CFP), and in 2007 was inducted as a fellow of the Canadian Securities Institute (FCSI). As a portfolio manager and CFP®, he works with clients across Canada and the USA. John Woodfield’s clients are families, individuals and business owners who understand the importance of comprehensive wealth and investment plans driven by the lifestyle they want to lead.

Schedule a Call

Schedule a 15-minute introductory call with SWAN Wealth Management. Click here to schedule a call.