Is Gifted Money Taxable in Canada?

Written by Tiffany Woodfield, TEP, Associate Portfolio Manager, CRPC®, CIM®

Gifting Money in Canada

Is gifted money taxable in Canada?

In Canada, gifted money is not considered taxable income.

That’s right—if someone gives you money as a gift, you don’t have to pay tax on it. Whether it’s $1,000 from a friend or $100,000 from a parent, there’s no gift tax in Canada. You also don’t need to report it as income on your tax return.

However, if that money earns interest or is invested, the earnings are taxable.

For example, if you deposit a $50,000 gift into an investment account and it grows, the growth is taxed. So, while the gift itself is tax-free, what you do with it next can impact your taxes or, if attribution applies, your parents.

The attribution rules are designed to prevent family members from moving money around just to lower their tax bracket. This includes income splitting with spouses and children under 18.

For example, if your mom gave your dad money or property the gift may not be taxable, but any income earned from that gift (like interest or dividends) is still taxed in your dad’s name. These rules are complex, and I recommend speaking to your tax advisor to understand your situation.

How much money can a person receive as a gift without being taxed in Canada?

There’s no limit—you can receive any amount as a gift in Canada without paying tax.

Whether it’s $500 or $5 million, the Canada Revenue Agency (CRA) does not tax the gift itself. However, the person giving the gift may face capital gains tax because of a deemed disposition if they gifted property. And the attribution rules may apply if they gifted it to a family member. That makes Canada very different from the United States, where they have gift tax.

However, if you are a cross-border individual, this is where things can get tricky. If a U.S. person gives a large gift to someone in Canada, it may need to be reported on a U.S. tax return. If you're a U.S. person living in Canada, it's smart to work with a dual-licensed advisor to avoid mistakes or surprises on either side of the border.

Are foreign gifts taxable in Canada?

Foreign gifts are not taxable in Canada, but they may need to be reported.

If you receive more than $100,000 from a foreign source (like a family member in the U.S.), you may need to file Form T1142 with the CRA. This is not a tax form but a reporting form. The gift itself remains tax-free in Canada, but failure to report it can result in penalties.

For cross-border families, it is especially important to track large international transfers, as the CRA does pay attention to such transactions. Working with a cross-border financial advisor helps ensure that your paperwork is accurate and your taxes remain straightforward.

What are the rules for gifting money to family members?

In Canada, you may face attribution rules when you gift money to certain family members.

If you’re considering gifting money to family members, it’s crucial to be aware of the attribution rules that may apply. These rules come into effect when you transfer property to specific individuals, such as your spouse, minor children, or minor nieces and nephews.

When the property you’ve gifted generates passive income or taxable capital gains, that income can be attributed back to you. As a result, the money you gift will be taxed under your name rather than that of the recipient.

These attribution rules are designed to prevent individuals from shifting income to their non-arm’s-length relatives to reduce their tax liabilities

For your spouse, both the income and any taxable capital gains from the transferred property can be attributed back to you, and for minors, just the income can be attributed back to you.

It’s also important to note that if you decide to use a trust in your gifting strategy, the same attribution rules can apply. If you gift money to a trust where the money is payable to one of these beneficiaries, the income and taxable capital gains from that trust may still be taxable in your name.

How does the Canada Revenue Agency know you received gifted money?

The CRA might learn about gifts through banking records or audits.

While gifts aren’t taxed, unexplained deposits can raise questions. If a large sum appears in your account (especially from overseas), the CRA might ask where it came from. That’s why it’s smart to document any big gifts.

A simple letter or email confirming it was a gift can be helpful. If the amount is over $100,000 and comes from outside Canada, you may also need to file a special form (T1142).

Keeping paperwork in order helps avoid delays or confusion with the CRA, especially for cross-border families moving large sums between countries.

What happens if you don't report a gift to the CRA?

If the gift came from inside Canada, you don’t have to report it the same way as if it were foreign.

But if the gift is from abroad and it's over $100,000, failing to report it can lead to penalties. The CRA doesn’t tax foreign gifts, but it does want to know about large foreign transfers.

If you miss filing Form T1142, you could face fines of $25 per day, up to a maximum of $2,500.

Is gifted property treated differently from gifted money?

Yes—gifting property can trigger capital gains tax, even if no money changes hands.

When you gift something valuable like a cottage, stocks, or land, the Canada Revenue Agency treats it as if you sold the property at its fair market value. This is called a deemed disposition. If the current value of the property is higher than what you originally paid (known as the tax cost), you could face a capital gains tax bill.

For example, if you bought a vacation home for $300,000 and it's now worth $800,000, gifting it to your adult child would be treated as if you sold it for $800,000. On paper, that’s a $500,000 gain—even though no cash was exchanged.

This rule often surprises people. That’s why it’s essential to speak with a tax advisor or financial advisor before gifting valuable property. It can help avoid costly surprises.

Key Points About Gifted Money and Tax Rules in Canada

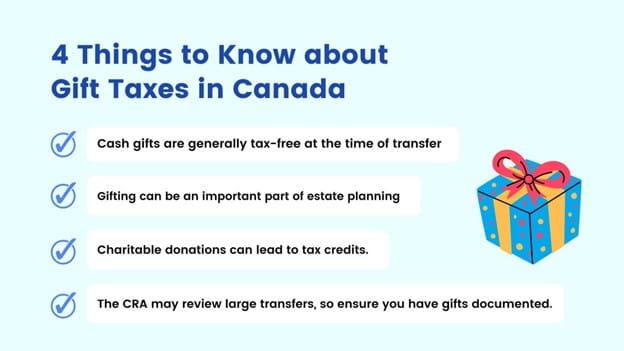

- Is gifted money taxable in Canada? Generally, cash gifts are tax-free, but what happens next—such as investment income—can create tax consequences. You also need to be aware of the attribution rules, so speak to your tax professional first.

- The Income Tax Act governs how gifts, including capital property and non-cash gifts, are treated for income tax purposes.

- The Canada Revenue Agency may review large transfers, especially those involving foreign funds or property transferred between family members.

- Using a Tax-Free Savings Account (TFSA) is one way to reduce the long-term tax burden of investing a financial gift.

- Always consult a financial advisor or tax advisor before making large gifts, especially those involving capital gains, deemed proceeds, or gifted property.

- All gifts, whether such gifts are large or small, should be reviewed with a cross-border financial advisor if U.S. connections or financial institutions are involved.

- For estate and financial planning, thoughtful gifting can reduce probate fees and shift wealth efficiently, but poor planning can raise red flags with the tax court.

Key Points about Gifted Assets, Such as Property or Stocks

- Gifted property is different from gifted money. If the fair market value of gifted property, such as a home or vacation property, exceeds the tax cost, you may face capital gains tax due to the deemed disposition rules. Remember, the tax liability is on the person gifting the property and not on the person receiving the property.

- Transferring a principal residence as an outright gift is generally tax-exempt, but rules differ if the home isn’t your primary residence. (+)

- The CRA looks at net income, expenses incurred, and proceeds equal to the value received, especially when the property involved is not straightforward.

Key Points about Charitable Donations

- Charitable contributions can be carried forward up to five years, subject to the total donations limit of 75% of net income.

- Charitable donations—whether cash gifts or donating capital property—can lead to tax benefits such as donation tax credits and tax deductions.

- To claim tax benefits, ensure the charity is among registered charities and that it issues official donation receipts.

- Donations involving ecologically sensitive land or gifts of personal property like art or jewelry must be valued at fair market value and may require appraisal.

- Certain non-cash gifts from private corporations may lead to unexpected tax issues, such as double taxation or being considered taxable benefits.

Common Questions

Do I have to pay taxes if my mom or dad gives me money?

No, you don’t pay taxes if your parents give you money in Canada. Let’s say your dad gives you $100,000 to help with a home purchase or a new business. You won’t owe tax on that gift. But there are two things to watch for. First, if the money earns investment income, that growth is taxed, and the attribution rules may apply if you are a minor. Second, if your dad is in the U.S. or the funds are coming from abroad, you may need to consider U.S. gift tax rules. In these cases, we recommend speaking with a cross-border advisor or accountant. They’ll help you stay clear of unwanted tax trouble on either side of the border.

Do I have to report gifted money as income?

No, you do not report gifted money as income in Canada.

If your aunt sends you $20,000 for your wedding or your parents give you $200,000 for a home, you don’t include that on your tax return. It’s not considered income by the CRA. But if that money earns income—say you invest it and it grows—then the growth is taxable.

This is where documentation can help. Keep clear records showing the money was a gift, especially if the CRA ever asks. For large gifts, a letter or banknote stating “gift” can make things easier down the road.

Final Thoughts

In Canada, receiving a gift of money or property might seem simple. But it’s important to understand how it affects your taxes.

Cash gifts are not taxed, and you don’t need to report them as income. But if you invest that money or give away property like real estate or stocks, you could face taxes on future gains or a capital gain at the time of the gift. Keeping clear records and understanding the rules can help you avoid confusion and make the most of any financial gift.

For those with cross-border ties—such as Americans living in Canada, dual citizens, or Canadians receiving large gifts from abroad—the rules are more involved. You may need to file special forms or consider U.S. tax implications. A cross-border financial advisor can help you handle gifts wisely, protect your wealth, and avoid penalties on both sides of the border.

Next Steps

If you’re a Canadian resident or are planning on moving to Canada or the US and need assistance with moving and optimizing your investments, estate planning, wealth management, and portfolio management, please get in touch. At SWAN Wealth, we specialize in Canadian financial planning, cross-border financial planning, and cross-border wealth management.

Read More

If you’re planning a cross-border move, these articles and guides will help simplify your move and ensure you’ve covered everything.

- Are Gifts Taxable in Canada?

- Do Dual Citizens Pay Taxes in Both Countries?

- Inheritance Tax in Canada

- Tax Planning Strategies in Canada

- Foreign Tax Credits in Canada and the US

About the Authors

Tiffany Woodfield is an Associate Portfolio Manager licensed in Canada and the USA, a Chartered Investment Manager (CIM), a Chartered Retirement Planning Counselor (CRPC), a Trust and Estate Practitioner (TEP) and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany advises clients who live in Canada and the United States and want to simplify their cross-border financial plan, move their assets across the border, and optimize their investments to minimize their tax burden. Together, Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe, whether they live in Canada or the U.S.

Schedule a Call

Schedule a 15-minute introductory call with SWAN Wealth Management. Click here to schedule a call.