401(k) in

Canada

What to Do with Your 401(k) in Canada

Written by Tiffany Woodfield, CRPC®, CIM®, TEP®, Senior Financial Advisor, Associate Portfolio Manager

What to Do with Your 401(k) in Canada

What should I do with my 401(k) in Canada?

When retiring from the US to Canada, many people discover that their 401(k) might not be the best retirement vehicle. Once you have moved to Canada, the 401(k) is frozen and cannot be actively managed. In many cases a holder cannot see the individual holdings.

Once an account is restricted, it is hard to find information on what to do and there is usually nobody there to help.

-

Is there a way to have your 401(k) moved and managed from Canada?

-

What are the options?

US persons want two basic things: to be onside with the IRS and to avoid a large tax bill.

One option may be to move a 401(k) or 403(b) into a rollover IRA and have the IRA managed from Canada. In order to do this, a dual Canada/USA licensed cross-border financial advisor is needed. This dual licensing means an advisor is familiar with the rules regarding rollovers to an IRA and can guide an individual on how it can be managed whether they live in Canada or the USA.

This type of rollover also works with multiple 401(k)s or 403(b)s that need to be simplified to plan an income stream now and into the future.

It is possible to transfer a rollover IRA into a Canadian RRSP, but this is often not the best solution for U.S. citizens because it will likely result in double taxation.

In addition, when an individual transfers an IRA to a RRSP, there are withholding taxes in the US. It would be necessary to top up the RRSP with funds from another source to fully offset the IRA income inclusion in Canada.

If the taxpayer doesn't have other sources to top up the RRSP, this room will be lost forever and the taxpayer will be taxed in Canada on the difference between the amount of the IRA and the amount contributed to the RRSP.

In addition, an IRA may be a superior vehicle because it allows an investor to name multiple non-spouse beneficiaries for tax deferral; whereas, with the RRSP/RRIF, one can only name their spouse for tax deferral purposes.

After the last surviving spouse passes, the RRSP/RRIF goes to the estate, and taxes must be paid by the estate at the deceased taxpayer’s marginal tax rate.

These additional taxes paid in the year of passing on an RRSP/RRIF greatly reduce the funds an individual would leave to their beneficiaries. An IRA enables the beneficiaries to stretch the taxable income over a number of years and exclude the value from the deceased’s terminal tax return.

Table of Contents

Summary of Key Points:

-

If you're an American moving to Canada, do not collapse your 401(k). It can be moved into a Rollover IRA and be managed from Canada by a dual-licensed advisor.

-

Do not transfer your 401(k) or Rollover IRA into an RRSP.

-

Minimize exposure to anything the IRS treats as a PFIC (Passive Foreign Investment Company).

-

You may be entitled to both the Canada Pension Plan and US Social Security benefits depending on your work history.

-

Plan ahead by consulting with a cross-border financial advisor, so you can understand the options on how to move your 401(k) to Canada and keep the tax deferred status.

-

Have a pre-immigration consultation with a cross-border accountant.

-

Understand the 401(k) equivalents in Canada.

What Are 401(k) Equivalents in Canada?

A 401(k) is similar to a Canadian Group Retirement Savings Plan.

They both were set up by governments to help people save for retirement and are administered by an employer.

These plans allow an employee to divert a portion of their salary into long term investments and the employer may match the contribution of the employee up to a limit.

A Roth 401(k) is similar to a Canadian Group TFSA in that a person can contribute with after-tax money so there is no deduction when they contribute, there is tax free growth, and the withdrawals aren’t taxed if the withdrawals meet certain conditions.

3 Main Differences Between a Canadian RRSP and 401(k)

1) Set Up

The main difference between a RRSP and 401(k) is that a 401(k) is usually set up in the US through an employer and contributions are deducted from the employee’s paycheck. Or if you are self-employed you can set up an individual 401(k). A Canadian self-directed RRSP is opened by an individual as long as they have earned income in the year prior. A Group RRSP is similar to a 401(k) and is set up and opened with an employer.

2) Withdrawal Penalty

A Canadian RRSP does not have early withdrawal penalties, aside from withholding tax and income tax; whereas, a 401(k) has a 10% penalty for early withdrawal. This penalty applies if someone withdraws money prior to turning age 59.5.

3) Contributions & Carry Forward Rules

The RRSP contribution limit is 18% of an individual’s previous annual salary and other earned income. The unused RRSP room can be carried forward indefinitely and used in a future year. However, you cannot contribute to an RRSP for yourself or a spouse who turned 71 in the year prior.

A 401(k) contribution limit is not based on income, but a standard yearly amount set by the IRS, and the contribution room cannot be carried forward. The 401(k) also offers a “catch-up” provision with higher contribution levels after age 50.

The contribution limit for a 401(k) in 2025 is $23,500 under age 50 and $31,000 if age 50 or older by year-end. Note that for ages 60-63, a higher catch-up contribution of $11,250 applies, making the total $34,750.

%20in%20Canada%20(3).jpg)

%20in%20Canada%20(2).jpg)

%20in%20Canada%20v3.jpg)

%20in%20Canada.jpg)

Similarities Between a Canadian RRSP and 401(k)

A Canadian RRSP and a 401(k) plan are designed to build savings to help plan for retirement.

They are government sponsored and have rules and contribution limits. All the money in an RRSP or 401(k) are pre-tax dollars. The exception is a Roth 401(k) which is after-tax contributions.

With both plans, holders have the benefit of tax-deferred growth and only pay tax when they withdraw funds. Both plans allow a diverse mix of investments such as stocks, bonds, mutual funds and GICs.

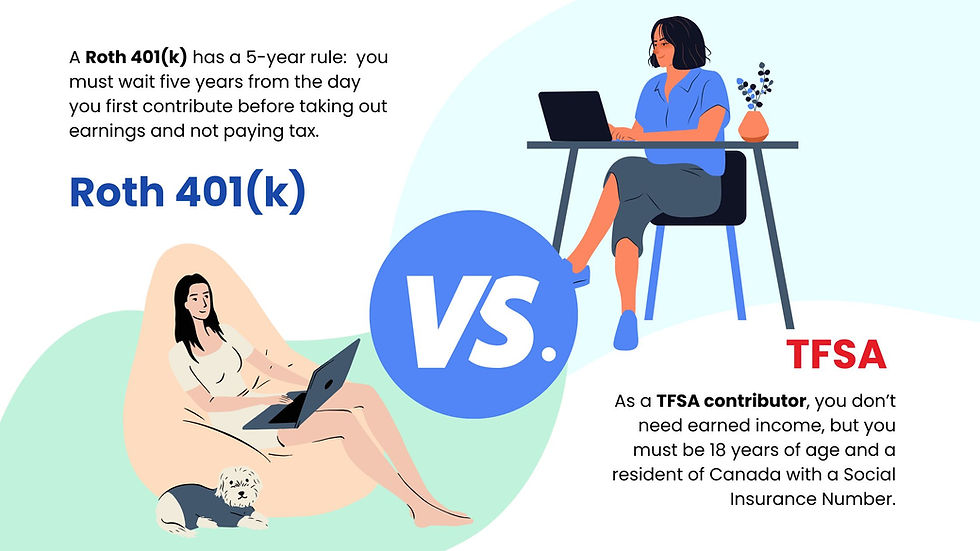

Roth 401(k) vs. TFSA in Canada

A Roth 401(k) and a TFSA are similar in that they are both funded with after-tax dollars, allow tax-free growth, and contributions are not deductible.

The main difference is the rules around how to contribute, the amount that can be contributed, and when to withdraw.

A Roth 401(k) has a 5-year rule. This 5-year rule means someone must wait five years from the day they first contribute before taking out earnings to avoid an early withdrawal penalty and owing income taxes.

A TFSA contributor doesn't need earned income, but they must be 18 years of age and a resident of Canada with a SIN.

A Roth 401(k) is an employer program, and only taxpayers with earned income can contribute.

In 2025, the yearly limit for a TFSA is CAD 7,000, whereas the 2025 limit for a Roth 401(k) is USD 23,500 and up to USD 31,000 if the taxpayer is 50 or older (with a higher total of USD 34,750 for ages 60-63 due to an increased catch-up contribution).

Background on TFSAs

TFSAs came into effect in Canada in 2009.

Contributors must be Canadian residents and at least 18 to accumulate room in a TFSA. The annual contribution limit ranges from CAD $5,000 to $10,000. If someone has never contributed but was a Canadian resident and at least 18 in 2009, they will have $102,000 of room in their TFSA in 2025 and $109,000 in 2026.

The annual limit adds to a taxpayer’s TFSA contribution room at the beginning of each year.

It's important to note that a brokerage TFSA may not be the best tool for a US person living in Canada.

The IRS considers it taxable, and it may be seen as a foreign trust, causing complicated tax filing and extra fees. It's important to speak to your cross-border accountant and cross-border financial advisor before opening a TFSA.

RRSP vs. Group RRSP

An RRSP is a Registered Retirement Savings Plan that can be set up by an individual or as a Group Retirement Savings Plan.

The major difference is an RRSP is set up by the individual and a Group RRSP is set up by an employer for the employees as a benefit.

The employer’s contributions are tax-deductible for the business and employers will often match the employees’ contributions as a percentage or dollar match up to a maximum.

The employees can contribute directly from their payroll using pre-tax dollars. Both plans allow pre-tax money to grow tax-deferred until it is withdrawn and then it is taxed at their marginal rate.

How to Bring 401(k)s and IRAs to Canada

The way to bring a 401(k) to Canada is to rollover the 401(k) to an IRA and have it managed from Canada.

If an individual works with an advisor who is licensed in Canada and the US (dual licensed), they can do this rollover before they move to Canada, or once they are in Canada.

Multiple 401(k)s can be rolled into one IRA to make retirement planning easier when planning income streams and when one needs to take Required Minimum Distributions (RMDs).

For more info on 401k Canada, read this post about moving your 401k to Canada.

Retirement in Canada vs. USA

CPP, Old Age Security, and Social Security

The Canada Pension Plan (CPP) and US Social Security are government-sponsored, mandatory old-age pension systems.

They are both funded by wages and provide retirement, disability, and survivor benefits.

In Canada, the income limits, tax rates, and benefits for CPP (Canada Pension Plan) are generally lower than those for U.S. Social Security. The amount a person receives from CPP depends on their income and how much they contributed through mandatory payroll deductions during their working years.

The maximum monthly Social Security retirement benefit in 2025 is USD 5,108 for someone who earned full credits and delayed benefits until age 70.

The maximum Canadian Pension Plan (CPP) monthly retirement benefit in 2025 is CAD 1,433.

Canada also has an Old Age Security (OAS) pension that starts at age 65 and is based on time spent living in Canada after the age of 18. The average OAS payment in 2025 is approximately CAD 735. Exact averages can vary by quarter and are not always published uniformly.

The government can claw back that OAS payment if someone earns more than CAD 93,454. It will be reduced to zero if their income is more than CAD 148,541 if between ages 65 and 74, or $154,196 if age 75 and over.

Note: According to the Canadian government website, these numbers are "not final for the 2025 income year and will be adjusted to reflect the quarterly adjustment of OAS benefits for the remaining quarters of 2025."

Minimize Your Retirement Tax Burden as a Dual Citizen

The main tactics to prevent overpaying taxes as a dual citizen are:

-

Minimize exposure to anything the IRS sees as a Passive Foreign Investment Company (PFIC) as this causes increased reporting and potential taxes.

-

Keep investments in an IRA and have it managed from Canada rather than transferring to a RRSP.

-

Work with an advisor that knows the investments that are beneficial to a Canadian resident and do not cause an additional IRS tax liability.

-

Work with an accountant familiar with both Canadian and U.S. tax obligations, foreign tax credits, and who understands the Canada-U.S. Income Tax Treaty.

Working with a Cross-Border Financial Advisor and Accountant Is Critical

Before moving, a US citizen or green card holder should consult with a cross-border financial advisor and a cross-border accountant to prevent costly mistakes.

The US advisor is no longer licensed to help once a move to Canada is made. A cross-border financial advisor can advise on which accounts to keep and what not to do. A cross-border accountant can help plan ahead to mitigate what could be a large taxable event.

Once you become a Canadian tax resident, the Canada Revenue Agency will expect you to report worldwide income, including withdrawals from your 401(k).

Coordinating CRA rules with IRS requirements is key to avoiding double taxation.

Working with a cross-border financial advisor and accountant helps ensure you have the guidance and support needed to optimize your investments while also avoiding double taxation.

🔎 Case Study: How Caroline and Amanda Prepared for Retirement in Canada with a 401(k) and Roth IRA

The Problem

Caroline and Amanda* are a married couple living in Minnesota who are planning their retirement.

Caroline, a 66-year-old US citizen, manages the couple’s finances and is already retired. Amanda, 64, is a long-term US green card holder originally from Canada who plans to retire within the next year or so.

Together, they’ve decided to move to eastern Canada once Amanda retires. However, before reaching out to SWAN, they were unsure how to manage Amanda’s US-based retirement accounts, which include a 401(k) and a Roth 401(k).

As they prepare for this move, they’re worried about making mistakes that could cost them in the future. They want clarity on how to transition financially from the US to Canada while minimizing taxes and complexity.

Caroline reached out for help after feeling overwhelmed and unsure about what steps to take.

The Solution

The SWAN team began by helping Caroline and Amanda establish a clear plan before their move. We worked with them while they were still living in the US, which allowed plenty of time for strategic financial and tax planning.

Here’s what the process involved:

-

Maintaining the 401(k) during employment: Amanda continued contributing to her 401(k) while employed, which allowed her to receive employer matching benefits.

-

Moving other investment accounts now: SWAN opened accounts for Caroline and Amanda. They didn’t realize we can start managing their IRAs and non-registered accounts while they are still US residents. They didn’t need to change currency or trigger a taxable event.

-

Delaying the 401(k) rollover: Working with SWAN Wealth and a cross-border tax advisor, they decided not to roll over the 401(k) until Amanda officially retired. Once Amanda stops working, she will roll her traditional 401(k) into an IRA and her Roth 401(k) into a Roth IRA. This strategy helps ensure no tax is triggered at the time of rollover, maintaining tax neutrality.

-

Tax residency planning: The SWAN team is now helping them prepare for the unique tax situation that comes with being a tax resident in both countries during the transition year. By doing this in advance, they’re avoiding rushed decisions and optimizing tax efficiency.

-

Cross-border tax consultation: The couple also had a cross-border tax consultation with SWAN’s cross-border accountant to understand the implications of Amanda’s long-term green card status. If she were to give up her green card without planning, she might be classified as a “covered expatriate,” which could trigger a significant exit tax. The SWAN team reviewed this scenario with Amanda and Caroline, so they could consider whether naturalizing as a US citizen would be beneficial before moving.

* * *

*The case studies and client examples presented on this website are for informational purposes only. Names and identifying details have been changed to protect client confidentiality. These examples are based on real scenarios but do not constitute financial advice. Individual circumstances vary, and you should consult a qualified financial advisor before making any financial decisions.

Why This Works

This strategy works because the clients started planning well before their move, giving them time to make informed decisions.

They were able to retain valuable employer benefits in the US while also opening accounts that would serve them well after relocating to Canada. Early consultation with a cross-border accountant and cross-border financial advisor helped them avoid costly tax errors. It also helped them understand the legal and financial ramifications of relinquishing a US green card before making any decisions.

Additionally, by building a relationship with their advisor in advance, they’ve gained peace of mind and clarity, reducing stress during a significant life transition.

The Outcome and How Caroline & Amanda Feel

Now, a few months after their first call with SWAN, the following steps have been taken:

-

The couple’s joint non-registered investment and IRA accounts have been fully opened and set up

-

Amanda’s 401(k) is still active and will be rolled over after her retirement.

-

Their joint investment portfolio has been reviewed to identify any assets that could be transferred “in kind” (without being sold) to Canada.

-

The SWAN team has started rebalancing their accounts and is exploring capital gains/losses and planning opportunities.

Emotionally, Amanda and Caroline felt relieved and confident.

Caroline, in particular, expressed that she finally felt they were doing the right things and had support through the process.

They were excited to move to Canada to be closer to family and felt reassured knowing their financial foundation was handled. With the guidance and systems in place, they could stop worrying about what they might have missed and focus on the life they wanted to build.

Common Questions

In the United States, 401(k) plans have specific annual contribution limits set by the IRS. For instance, in 2025, the limit is $23,500 for individuals under 50, with an additional $7,500 catch-up contribution allowed for those 50 and over (increased to $11,250 for ages 60-63).

Understanding these contrbution limits is crucial for cross-border financial planning.High-income earners need to know how much they can contribute without incurring penalties and how these contributions affect their overall tax and retirement strategy when moving between countries.

After converting their RRSPs (Registered Retirement Savings Plans) into RRIFs upon retirement, Canadian residents begin receiving regular payments, which are taxable as income.

For those with 401(k) plans moving to Canada, it's essential to understand the similarities and differences between RRIFs and 401(k) distributions to manage and plan retirement income effectively.

Unlike 401(k) plans, contributions to a TFSA are not tax-deductible, but withdrawals are tax-free in Canada. For cross-border individuals, a TFSA can cause additional complications because it is considered a taxable account for the IRS and may be viewed as a foreign trust. Speak to your cross-border accountant and cross-border financial advisor to determine if a TFSA might still be an option for you as a Canadian tax resident.

RRSPs are Canadian retirement savings plans with tax-deferred growth, similar to a 401(k), except for contribution rules. To have contribution room in an RRSP, you must have worked in Canada because the amount you can put into an RRSP is based on earned income in Canada.

If you have investable assets of more than $1M, it's important to work with a cross-border advisor and accountant to ensure you avoid falling into any tax pitfalls or making any expensive cross-border mistakes.

If you have less than $1M in investable assets, it would still be wise to seek the advice of a cross-border accountant to make sure you’re on the right track.

As an American living in Canada, you must report your worldwide income to Canada and the US. Earnings in your 401(k) are tax-sheltered until you make a withdrawal, at which point you must report the income on your Canadian and US tax returns.

If you are a cross-border person living and working in Canada, an RRSP and group RRSP are good retirement savings accounts because they don’t cause extra tax complications.

If you are a Canadian living in the US, an IRA, Roth IRA, and 401(k) are good retirement savings accounts. They help you save for retirement and are recognized by the Canada-US Income Tax Treaty.

Canadian citizens working in the U.S. for a U.S. employer can participate in a 401(k) if the employer offers the plan. Eligibility depends solely on the employer’s offering and not the employee’s nationality. There's no citizenship requirement for participation.

The closest equivalent to a Roth RIA in Canada is a Tax‑Free Savings Account (TFSA). With a TFSA, contributions are made after tax, earnings grow tax-free, and withdrawals are tax-free. Unlike Roth IRAs, TFSA room carries forward; there are no eligibility income limits, and Canadians must be at least 18 years old with a SIN. Be careful if you overcontribute to your TFSA you may be subject to tax.

Upon moving to Canada, your U.S.‑based 401(k) generally becomes restricted (“frozen”) and often becomes unmanageable from Canada. Your best move may be to roll it into a Rollover IRA, which a dual‑licensed advisor can then manage.

When rolling your 401(k) into an IRA, the funds are transferred directly between U.S. financial institutions to avoid triggering taxes or penalties. Avoid transferring your 401(k) directly into an RRSP, as it may trigger double taxation and you may lose contribution room.

You can keep your 401(k) if you leave the U.S. When you leave the U.S., you don't have to close your 401(k). You can keep it or roll it into a Rollover IRA. Working with a Canada‑U.S. dual‑licensed advisor will help you maintain compliance with both the IRS and CRA.

A Canadian resident can only have a 401(k) if they work for a U.S. employer that sponsors the plan. 401(k) plans are not available to Canadians who are working and residing only in Canada. 401(k) plans are employment‑based, not nationality‑based. A traditional 401(k) is funded with pre-tax income, which lowers your taxable income in the year you contribute, which is similar to how RRSP contributions work in Canada.

“Better” depends on context. Generally you will want to contribute to an RRSP if you are living in Canada because it reduces your taxable income. If you are living in the U.S. you likely would want to contribute to a 401(k) or an IRA.

If you're searching for "401k Canada," then you're either a U.S. person who is planning a move across the border, or you're a Canadian wondering what the 401(k) equivalent is in Canada. If you're moving to Canada, you don't have to worry about closing down your 401(k) before moving. Instead, start working with a cross-border financial advisor who can help you understand how to manage your investments such as a 401(k) in Canada and the U.S.

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, SWAN Wealth Management, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member of the Canadian Investor Protection Fund. Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered.

📖 Check Out SWAN's Cross-Border Blog

About the Author

Tiffany Woodfield is a dual-licensed financial advisor and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield.

Tiffany specializes in advising clients who live both in Canada and the United States and need to simplify their cross-border financial plan, move their assets across the border, and optimize their investments so they can minimize their tax burden.

Together Tiffany and John Woodfield, CFP and Portfolio Manager, help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe whether they live in Canada or the US.